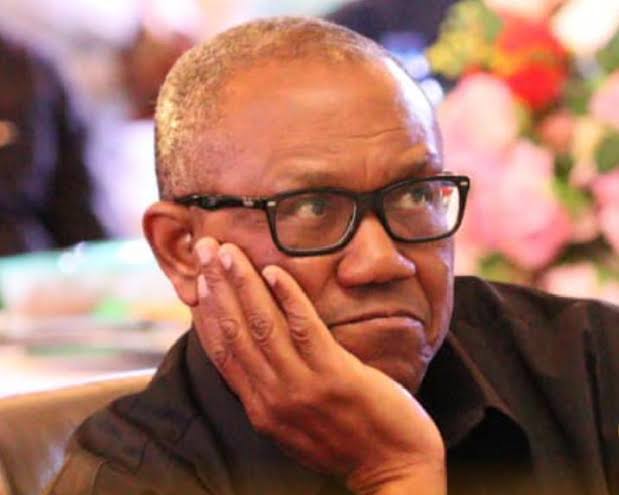

Former Anambra State governor Peter Obi has criticised the country’s approach to taxation, warning that raising revenue by imposing heavier burdens on poor citizens would undermine economic growth, social trust and national unity.

In a statement on his X account, Obi said prosperity could not be achieved by taxing poverty, arguing that taxation should operate as a transparent social contract rooted in fairness, honesty and visible public benefit.

“As I travel the world and meet leaders who have transformed their nations, one lesson is clear: lasting economic and social progress begins with national consensus,” Obi wrote.

He said governments must be truthful with citizens about how tax policies affect incomes and how revenues will translate into development outcomes.

The former Labour Party presidential candidate in the 2023 election, said taxation should not merely focus on increasing government revenue but on making citizens wealthier through production, enterprise and job creation.

“Nigeria must rethink taxation if it is serious about economic growth, national unity, and shared prosperity. The purpose of sound fiscal policy is not merely to raise revenue; it is to make the people wealthier so that the nation itself becomes stronger. Yet today, Nigerians are asked to pay taxes without clarity, explanation, or visible benefit” he said.

He argued that empowering small and medium-sized enterprises would naturally expand the tax base, rather than placing additional pressure on households already struggling with high living costs.

“You cannot tax your way out of poverty — you must produce your way out of it,” he said.

His comments come amid heightened public debate over Nigeria’s tax reforms and revenue measures. In recent months, the federal government has pushed to boost non-oil revenue as it grapples with rising debt servicing costs, a weak naira and the removal of fuel subsidies.

The reforms have included changes to value-added tax administration, excise duties and efforts to widen the tax net, which had taken effect this new year.

The debate intensified following controversy over a recently amended tax law, after the National Assembly acknowledged discrepancies between the version passed by lawmakers and the version later gazetted.

Obi referenced the episode in his statement, describing it as alarming and unprecedented. He said citizens were being asked to pay higher taxes under a framework whose legitimacy had been questioned, without clear explanations or assurances of public benefit.

“There is no virtue in celebrating increased government revenue while the people grow poorer,” Obi wrote. “Any tax system that makes citizens poorer violates the fundamental principles of good governance and sound fiscal policy.”

Nigeria’s tax-to-GDP ratio remains among the lowest globally, estimated at below 10 percent, according to official data.

Successive governments have said improving tax collection is essential to fund infrastructure, healthcare and education.

WARNING: If You Are Not 18+, Don’t Click The Link Below 👇🫣

https://stampstallionpalpable.com/kx6iepv2qm?key=6c14bd1d68e1eba721851f19778f5efe

Please don’t forget to “Allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post.

Never Miss A Single News Or Gist, Kindly Join Us On WhatsApp Channel:

https://whatsapp.com/channel/0029Vad8g81Eawdsio6INn3B

Telegram Channel:

https://t.me/gistsmateNG