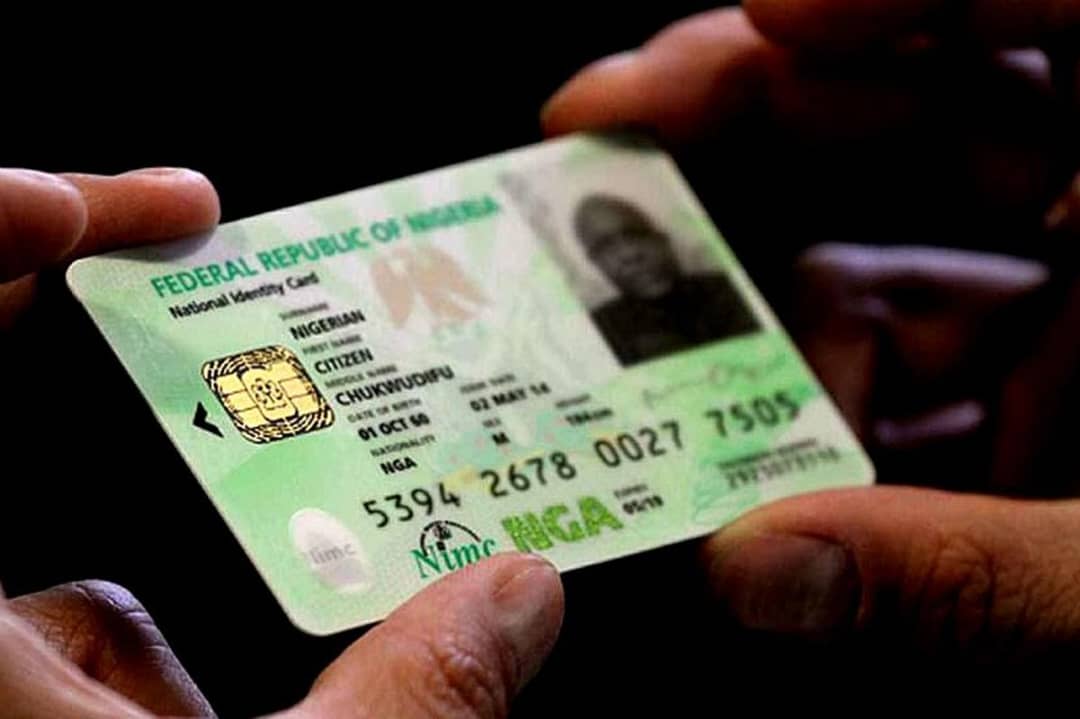

The Federal Government is set to roll out a landmark reform linking Nigerians’ credit scores to their National Identification Numbers (NIN), in a move designed to establish a unified and transparent credit system across the country.

Announcing the development at a State House media briefing in Abuja, Tuesday, Managing Director of the Nigerian Consumer Credit Corporation (CREDICORP), Uzoma Nwagba, said the initiative aims to consolidate credit data from all financial institutions, banks, fintechs, and microfinance providers into a central national credit bureau.

“This marks a fundamental shift in how credit works in Nigeria. Your NIN becomes your financial anchor. Whether you’ve borrowed from a bank, micro-lender, or fintech, your record will be tracked and will carry consequences,” Nwagba stated.

According to him, the move will build a national credit database, offering each citizen a credit profile shaped by their borrowing and repayment behaviour.

He warned that loan defaulters will soon face tangible consequences, including difficulty renewing passports, driver’s licenses, or securing housing. “There will be no hiding place,” he said.

All financial institutions, he added, will now be mandated to report credit activity. The system, however, is designed to encourage responsible borrowing without being punitive.

“This is not about punishment. It’s about promoting discipline and rewarding financial responsibility,” Nwagba explained.

He revealed that the system will also incorporate financial and non-financial data to generate a comprehensive credit scoring algorithm for every Nigerian adult.

“The goal is simple: every Nigerian must have a credit score. Access to economic opportunities will be tied to how you manage your finances.”

The broader objective, Nwagba noted, is aligned with President Bola Tinubu’s Renewed Hope Agenda, targeting improved living standards, reduced corruption, and industrial growth.

“This isn’t just about credit. It’s about giving people access to better lives. When people lack capital to meet their needs, they may resort to unethical practices. We’re changing that,” he said.

He added that the reform would also boost local production by tying credit facilities to the purchase of made-in-Nigeria goods, stimulating demand, creating jobs, and supporting sustainable economic growth.

Nwagba called on the private sector to actively support the initiative, stressing that Nigeria’s credit gap, estimated at ₦183 trillion, cannot be bridged by the government alone.

“No government can fund that level of credit. But with strong institutions and transparency, lenders will have more confidence, interest rates will fall, and Nigerians will have real access to affordable credit,” he said.

CREDICORP is also driving “YouthCred,” a new programme aimed at extending structured credit to young Nigerians, especially members of the National Youth Service Corps (NYSC).

“YouthCred is no longer an idea. It’s in motion. The systems are ready, and rollout is underway,” Nwagba confirmed.

Executive Director of Operations at CREDICORP, Olanike Kolawole, added that the programme is designed to instil financial confidence and inclusion among youths aged 18 to 35.

“YouthCred is not just about loans, it’s about building a financially literate generation. As we expand, we’re ensuring young people have the tools and habits to succeed,” she said.

The credit-NIN integration, both officials said, is also expected to transform how citizens interact with public services and civic processes in Nigeria.

WARNING: If You Are Not 18+, Don’t Click The Link Below 👇🫣

https://abnormalitylovingmammal.com/kx6iepv2qm?key=6c14bd1d68e1eba721851f19778f5efe

https://poawooptugroo.com/4/8902554

Please don’t forget to “Allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post.

Never Miss A Single News Or Gist, Kindly Join Us On WhatsApp Channel:

https://whatsapp.com/channel/0029Vad8g81Eawdsio6INn3B

Telegram Channel:

https://t.me/gistsmateNG

You make lives hard for people, deny people jobs and way of lives, but you want to link credit score to NIN in other to kill them completely, you don’t have money to fund credits but you have zillions to fund government vehicles and escalades, you have trillions to fund luxurious life for useless people in the government doing nothing for the citizens.

If you don’t want them to borrow, why not give them jobs, better their lives and watch the economy grow. There are average Nigerian graduates that do not have up to 1,000 naira in their accounts but they studied 5 to 7 years in school, job hunting, nobody cares.

That energy you are using in fighting citizens, why don’t you reciprocate it more on national assembly members, presidential boys and other administrative heads that embezzle funds, who is tracking them? Very useless idiots that have sworn to be evil on citizens.

I have watched the so called reforms, nothing to write home about, it doesn’t have any impact on citizens, every reform is against the citizens, it doesn’t show any disadvantage to the politicians. Useless animals!