The four tax reform bills submitted by President Bola Ahmed Tinubu in October 2024 are now ready for presidential assent following the harmonisation of the versions of the bills passed by both chambers of the National Assembly.

At plenary on Wednesday, the House of Representatives considered the report of the conference committee, which harmonised the bills.

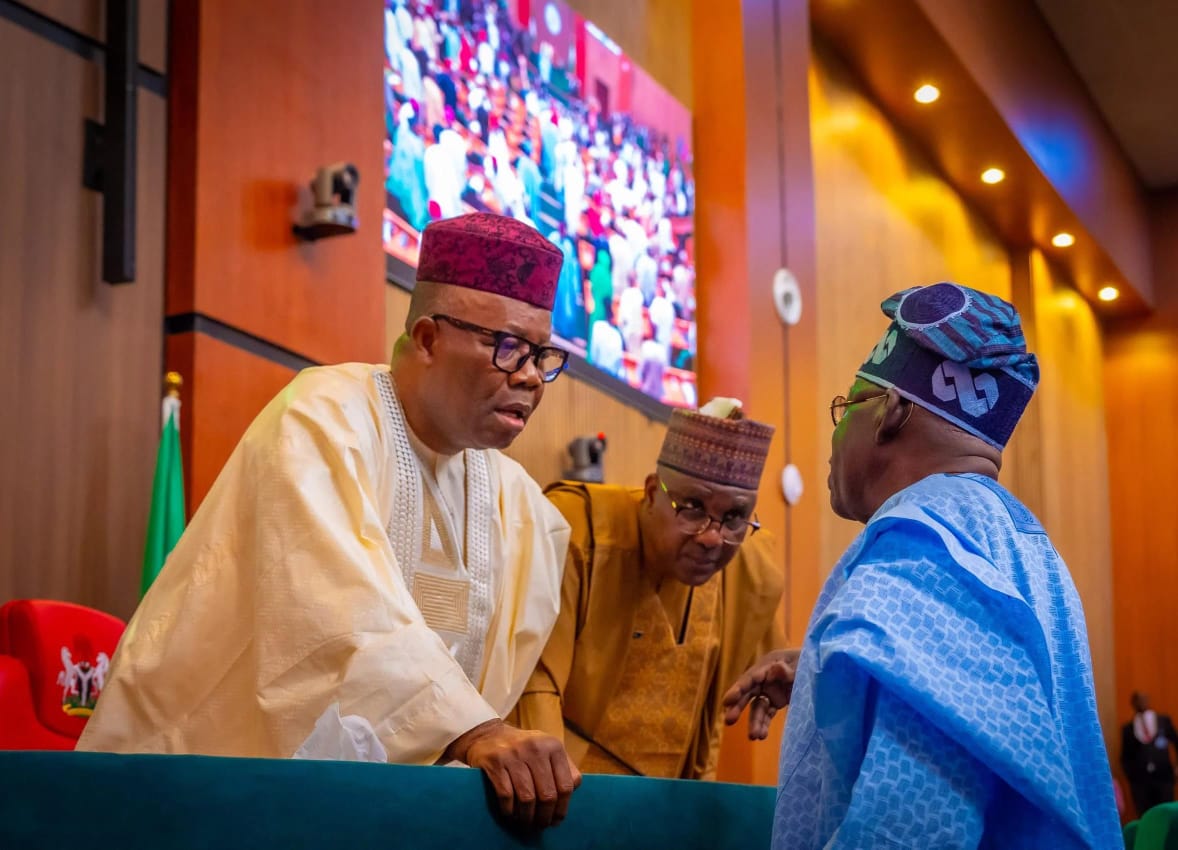

Chairman of the House Committee on Finance, James Abiodun Faleke (APC, Lagos), who headed the House team to the conference committee, presented the conference report to the House for consideration.

He said the conference committee met and agreed on all areas of difference in the version passed by both chambers of the National Assembly.

Faleke said that there were 45 areas of difference in the Nigeria Tax Administration Bill, 12 areas of difference in the Nigeria Revenue Service Bill, 9 areas of difference in the Joint Board Bill and 46 areas of difference in the Nigeria Tax Bill, adding that the differences were agreed upon and resolved by the committee.

While the conference committee agreed to retain the Senate version in some of the clauses, they also retained the House version in some others, making amendments in a few others.

The conference committee agreed to the imposition of a 4 percent development levy on assessable profit of all companies chargeable to tax under chapters two and three, other than small companies and non-resident companies.

They also agreed that the levy shall be collected by the Nigeria Revenue Service and paid into a special account created for that purpose.

In the sharing formula, the committee agreed that 50 percent of the tax will go to Tertiary Education Trust Fund, 15 percent to the Education Loan Fund (up from 3 percent agreed by the House), 8 percent to Nigeria Information Technology Development Fund (up from 5 and 10 agreed by both chambers).

Also, the National Agency for Science and Engineering Infrastructure is to get 8 percent (down from. 10 percent earlier agreed by both chambers), the National Board for Technology Incubation is to get 4 percent from the fund, defence and security infrastructure is to get 10 percent while cyber security fund will get 5 percent.

The Social Security fund, the Nigeria Police Trust Fund, National Sports Development Fund were excluded from the list of beneficiaries passed by the House of Representatives.

The committee, however, adopted a new clause 158, which imposes a 5 percent surcharge on chargeable fossil fuel products provided or produced in Nigeria and shall be collected at the time a chargeable transaction occurs.

A close study revealed that the contentious VAT sharing formula was not part of the areas of disagreement between the two chambers.

Speaking after the passage, Deputy Speaker, Benjamin Kalu said the National Assembly has shown great support for the progress of the country, adding that with the passage of the bills, the country has moved from where it was to where it ought to be.

He said the National Assembly will rise to take the country to prosperity, while commending Nigerians for the support they showed throughout consideration, saying the four bills will position Nigeria and put it on the path of growth.

Ahmed Jaha (APC, Borno) warned those who will clean up the bill not to tamper with any of the clauses passed, saying, “where the ‘T’ is not crossed, don’t cross it, where the ‘I’ is not dotted, don’t do it. We have the original copies of the bills as passed before and after harmonisation.

“We have had cases in the past where those in charge of cleaning up the bills tamper with them, and at the end of the day, the President will withhold assent. That must not happen”.

WARNING: If You Are Not 18+, Don’t Click The Link Below 👇🫣

https://disloyalmoviesfavor.com/m3e85u39j?key=f0014e9d9438d5115e4d66e73ca3f04b

https://poawooptugroo.com/4/8902554

Please don’t forget to “Allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post.

Never Miss A Single News Or Gist, Kindly Join Us On WhatsApp Channel:

https://whatsapp.com/channel/0029Vad8g81Eawdsio6INn3B

Telegram Channel:

https://t.me/gistsmateNG