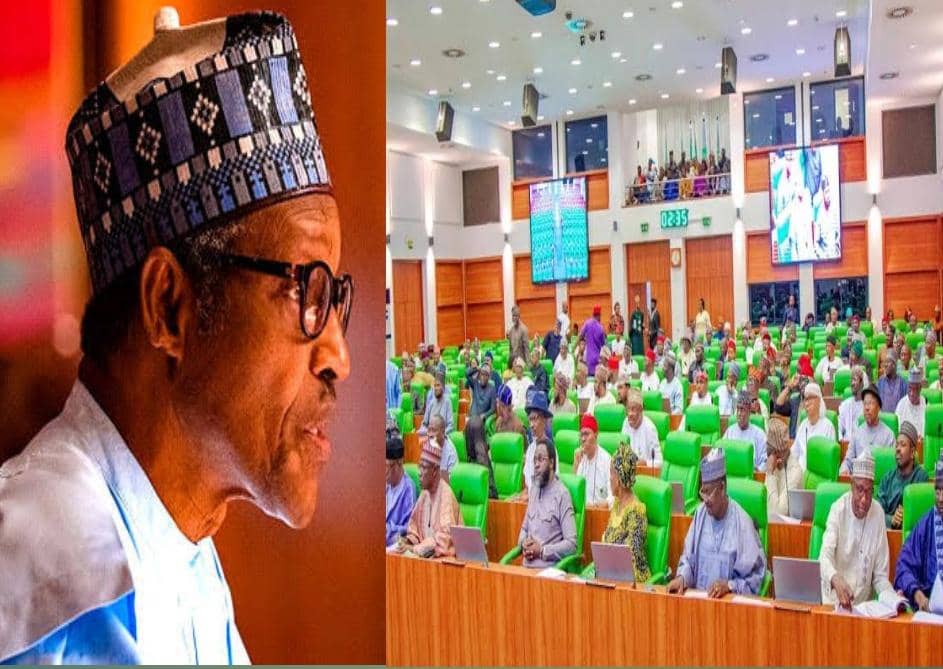

The House of Representatives has unveiled plans to launch a comprehensive investigation into the Road Infrastructure Development and Refurbishment Investment Tax Credit scheme, which was initiated by former President Muhammadu Buhari in 2019.

The decision follows the adoption of a motion of Urgent Public Importance brought forward by Hon. Ibrahim Aliyu during the plenary session on Wednesday.

The scheme, established through Executive Order No. 007, was designed to address Nigeria’s significant infrastructure deficit by encouraging private sector participation in road development.

Under the program, private companies that invest in the construction or refurbishment of eligible roads can recover their costs through tax credits against future Companies Income Tax (CIT) liabilities.

However, Hon. Aliyu raised concerns about the effectiveness and accountability of the scheme, arguing that, five years after its launch, has yet to deliver clear results.

In his lead debate, Hon. Aliyu emphasized the importance of ensuring public funds are used responsibly and questioned whether the scheme has truly contributed to bridging Nigeria’s infrastructure gap.

He noted that the Federal Government had previously stated that Nigeria would need approximately N348 trillion over a decade to close the nation’s infrastructure deficit. Despite this massive need, the results of the Tax Credit Scheme remain uncertain.

“The House observes that this Tax Credit Scheme was meant to encourage private sector participation in road infrastructure development in Nigeria.

It allows companies to recover costs incurred in constructing or refurbishing eligible roads as tax credits against their future Companies Income Tax liability,” Aliyu said.

Aliyu also pointed out that after five years, the scheme’s viability, efficiency, and overall cost-effectiveness of the projects completed under its umbrella have not been sufficiently evaluated.

The House resolution seeks to investigate the projects completed so far, as well as the mechanisms for ensuring accountability and transparency in how the scheme has been implemented.

The Tax Credit Scheme has been lauded for its innovative approach to solving Nigeria’s infrastructure problem by leveraging private sector resources.

Major corporations, including Dangote Group, have participated in the program, with some high-profile road projects being undertaken under the scheme.

However, critics argue that while the scheme offers short-term relief for some road projects, it may not address the long-term structural issues of underfunding and mismanagement in Nigeria’s infrastructure sector.

Some stakeholders have also raised concerns that certain projects may not have been cost-effective or that the benefits of the scheme could be disproportionately favouring large corporations at the expense of smaller businesses.

The House of Representatives has resolved to set up a committee to conduct a thorough investigation into the scheme.

The inquiry will focus on evaluating the overall impact of the program on Nigeria’s road infrastructure, the transparency of the project selection process, and whether the projects completed under the scheme have provided value for money.

“The House further observes that 5 years after its inception, the scheme’s effectiveness, which hinges on the viability and cost efficiency of projects undertaken, is yet to be ascertained,” Aliyu stressed during the debate.

Don’t Miss The Opportunity Awaiting You. Click the link below 👇

https://faikudoka.net/4/5193489

Please don’t forget to “Allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post.

Never Miss A Single News Or Gists, Kindly Join Us On WhatsApp Channel:

https://whatsapp.com/channel/0029Vad8g81Eawdsio6INn3B

Telegram Channel:

https://t.me/gistsmateNG