The Federal Government has appointed Dr. John Nwabueze as Nigeria’s first Tax Ombudsman, in line with the provisions of the Joint Revenue Board of Nigeria (Establishment) Act, 2025.

A statement issued by the Special Adviser to the President on Information and Strategy, Bayo Onanuga, said the appointment reflects the President’s broader fiscal reform agenda aimed at strengthening public confidence in Nigeria’s revenue system and improving compliance through fairness and due process.

Dr. Nwabueze, who hails from Oshimili South Local Government Area of Delta State, brings decades of experience spanning tax policy, fiscal reform, and economic governance.

He has served as Managing Partner of a top tax advisory firm, Technical Adviser to the Joint Senate Committees on the Federal Capital Territory and Finance, and Technical Adviser to the Chief Economic Adviser to former President Olusegun Obasanjo, among other roles in the public and private sectors.

The newly appointed ombudsman holds a Doctorate in Public Administration (Finance) from Walden University, Minneapolis, a Master’s degree in Accounting from Strayer University, Washington, D.C., and dual Bachelor’s degrees in Accounting and Mathematics from the University of Jos.

Trusted To Deliver

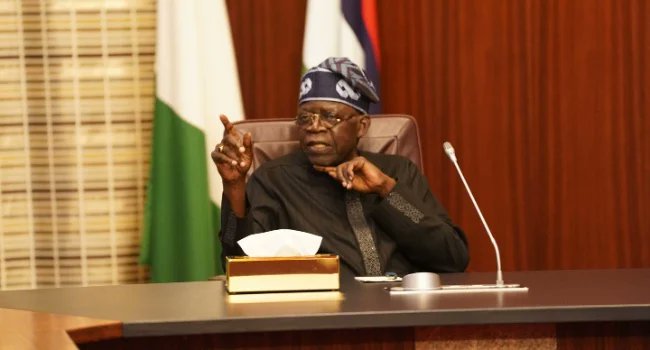

In congratulating Dr. Nwabueze, President Tinubu expressed confidence in his “capacity to discharge the responsibilities of the office with integrity, diligence, and utmost professionalism.”

The Office of the Tax Ombudsman, according to the statement, has been created to strengthen transparency and accountability within Nigeria’s tax system and provide a structured mechanism for fair and impartial resolution of disputes between taxpayers and revenue authorities.

The office will handle complaints related to taxes, levies, regulatory fees, customs duties, excise matters, and related issues, ensuring that disputes are managed efficiently, impartially, and in a non-adversarial manner.

Watchdog To Prevent Abuse Of Power

According to the statement, the Tax Ombudsman will also serve as a watchdog to prevent abuse of power and arbitrary decision-making by tax officials. This is expected to enhance taxpayer confidence, reduce litigation, and promote voluntary compliance with Nigeria’s tax laws.

“The creation of this office is a crucial step toward a more transparent and citizen-friendly tax administration,” the statement added. “It provides individuals and businesses a credible platform to seek redress where they believe tax authorities have acted unfairly or outside the law.”

Many have described the establishment of the office as a progressive reform that aligns Nigeria’s tax dispute resolution system with global best practices.

Similar offices exist in several advanced economies, serving as an independent oversight mechanism that balances government revenue collection with taxpayer rights.

Immediate Task

Dr. Nwabueze’s immediate tasks will include setting up the institutional framework of the new office, developing standard operating procedures for complaint resolution, and working closely with agencies such as the Federal Inland Revenue Service (FIRS), Nigeria Customs Service, and state revenue authorities to streamline processes and improve coordination.

The move comes at a time when Nigeria is deepening its fiscal reforms under President Tinubu’s administration, focusing on broadening the tax base, reducing leakages, and improving service delivery across all revenue-generating institutions.

By establishing the Office of the Tax Ombudsman, the government aims to institutionalize fairness and rebuild trust between taxpayers and tax authorities, an essential step toward achieving sustainable economic growth and improving Nigeria’s investment climate.

What You Should Know

In September, it was reported Nigeria’s tax reform laws have been officially published in the government gazette, marking a major step in overhauling the country’s fiscal framework.

The reforms, signed into law on June 26, 2025, establish a new foundation for taxation, administration, and revenue collection in Africa’s largest economy.

Confirming the publication on his official X handle, Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, noted that the new laws would modernize Nigeria’s tax system, improve compliance, and create a more business-friendly environment.

WARNING: If You Are Not 18+, Don’t Click The Link Below 👇🫣

https://rayvirtual.com/m3e85u39j?key=f0014e9d9438d5115e4d66e73ca3f04b

Please don’t forget to “Allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post.

Never Miss A Single News Or Gist, Kindly Join Us On WhatsApp Channel:

https://whatsapp.com/channel/0029Vad8g81Eawdsio6INn3B

Telegram Channel:

https://t.me/gistsmateNG